Home Page / OMG Home Page / Government / Miscellaneous / DWP Page

Update - A letter has been sent to the Adjudicator - 28th February 2012

On February 1st, 2012, the Daily Mail published an article which basically said that although an adjudicator facility was available for anyone who was complaining to HMRC this information was not generally available. The article furnished the information that an individual, such as myself could utilise. So, I decided to take advantage of this appeals process and composed a letter yesterday which has now been sent to the Adjudicator as I actually don't believe the 'complaints' process was as 'open' as it could have been and the amount of time and resources spent to claw back such a paltry sum is really shameful. Here is my letter to the Adjudicator:

Date: 27th February 2012

Adjudicator’s Office

8th Floor Euston Tower

286 Euston Road

London NW1 3US

Dear Sir / Madam

Ref: J****** A*** L***** (nee W*******) – DOB – **.**.****

National Insurance No: YT******A – Tax Reference : 5**/5*****

I have now been in correspondence with officers of HMRC since October 2011 with reference to a demand for underpaid taxes. I have chosen to dispute this matter with HMRC as to my certain and absolute knowledge, I have not at any time, in over 30 years of paid employment ever attempted to avoid payment of any taxes due to the government. During my paid employment I have always had tax deducted under the PAYE scheme and when I became medically retired and was advised by the appropriate government bodies that I must apply for and claim Employment Support Allowance I immediately submitted details of my income to HMRC for appropriate deductions to be made.

Between October 2011 and 18th February 2012 I have been subjected to the worst sort of abuse, discrimination, illiteracy and mismanagement by HRMC and which is the basis of the complaint that I have now been forced to submit to you in the hope that you may curb this sort of practice in the future.

On 13th March 2011 I received two separate notifications of PAYE Coding Notices (Appendix 1 printed double-sided showing both documents) – HMRC stated that the tax code for my Notts. County Council Pension would be 404T and for my Employment Support Allowance would be 342L. I was more than a little surprised to receive these as I did not yet know what my NCC Pension would actually be and NCC would not be able to provide this information until after the start of the new financial year – 6th April 2011.

On receiving the appropriate information I rang HMRC to inform them that their projected calculations were incorrect and received a revised tax code of 390L replacing 342L previously assigned. The special notice on the back of the letter confirmed that this was revised on the information I had provided to HMRC. (Appendix 2 printed double-sided showing both documents).

I also received a Form P60U which showed the total ESA claimed up to 5th April 2011 was £3247.32. (Appendix 2 printed double-sided showing both documents).

To all intents and purposes I had fulfilled my obligation to HMRC and provided them with all the information that they would need for the tax year 2011/12 which would be the first full year when my taxable affairs were not being administered by my employers.

I also received a P60 End of Year Certificate from my employers which indicated total pay for the year as £10,273.29 with tax of £1213.20 deducted using a final tax code 343T. This would have been based on the date of my medical retirement – 19th May 2010 - in the tax year 2010/11 which highlighted a great reduction in my income as I moved from paid employment to a pension. (Appendix 3).

On receiving two separate notifications from HMRC in October 2011, I queried the tax demand that I had been issued as I had believed all my taxable income had been declared and that my tax affairs were in order. The P800 stated that I had overpaid tax in the year 2009-10 and underpaid in the year 2010-11 by £11.44 and £195.80 respectively leaving me with a balance of £184.36 owed to HMRC.

On 10th October 2011 I wrote to HMRC in the hope that they would agree that my claim was valid under the A19 rule owing to their “failure more than once to make proper use of the facts they had been given about my sources of income.” I based this on the two items of correspondence they had sent to me (see Appendix 4 double-sided showing both documents).

Their ill-composed response, dated 2nd November (and attached as page 1 of 2 of Appendix 5), stated that ‘The underpayment of tax for 2010-11 has arose because ……’ This same documentation, which rejected my appeal further states “As the underpayment cannot be collected through your code number we will contact you with regards payment of the outstanding tax of £184.36.”

Following on from the statement made in the letter dated 2nd November, 2011 namely “As the underpayment cannot be collected through your code number we will contact you with regards payment of the outstanding tax of £184.36” – imagine my absolute horror, to receive, shortly afterwards, on 21st November, a letter dated 16th November 2011.

This communication (ref: 961507/504800 – UST) states that it refers to my letter of 12th October – (in reality my letter was dated 10th October, sent on 11th October and in all probability the office ‘received stamp’ showed the date as the 12th)is proof of the unprofessionalism employed by employees of HMRC if they permit this lack of attention to detail in their work ethic.

The letter begins by stating “I have been unable to contact you about this as we do not hold a phone number on record.” My letter of the 10th, as all my correspondence with any Government department or any other correspondent requiring written information, uses the same template heading as this letter – namely my full address, landline telephone contact number and e-mail address.

This communication further states that if I do not make contact one of the options is that HM Revenue and Customs will ‘recover any overdue tax ….. by taking legal proceedings.’

I was more than a little concerned to receive a threatening communication of this nature which can only have been composed by a professional bully but which the HMRC do not perceive as threatening. (Definition of a bully from the Oxford On-Line Dictionary - a person who uses strength or influence to harm or intimidate those who are weaker. (Appendix 5 printed double-sided showing both documents).

Because of the manner of this letter and the length of time it had taken to reach me I rang the number given on the correspondence and after a wait of approximately 45 minutes spoke to a call-taker who at no time indicated that he was just that, a call-taker who would pass on a message to a relevant team who would then ring me within a certain ‘window’ that is proscribed as appropriate with only the minimum of information as to when that might occur.

It was at that point that I decided to escalate the matter to the Complaints department of HMRC as I felt it was unfair to receive correspondence of a threatening kind, illiterate correspondence, correspondence that clearly contained lies an/or misinformation and on top of everything else gave a telephone number that did not at any time indicate that this was a call centre, message-taking, re-routing facility.

In the meantime, whilst awaiting a response from the complaints team I issued a cheque to HMRC for the amount demanded which was encashed on 21st December 2011.

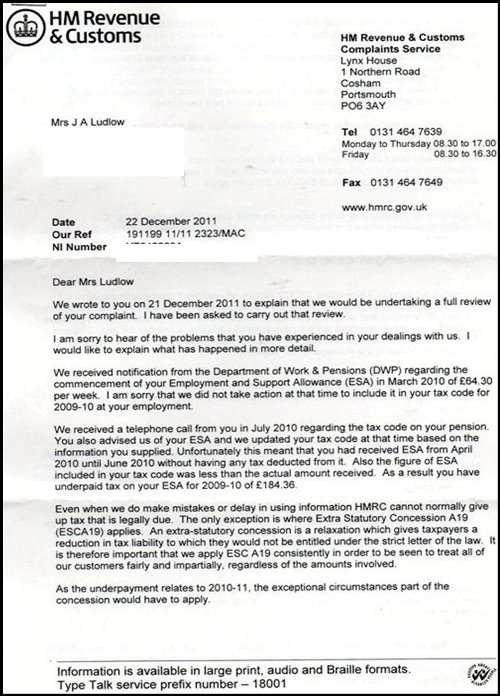

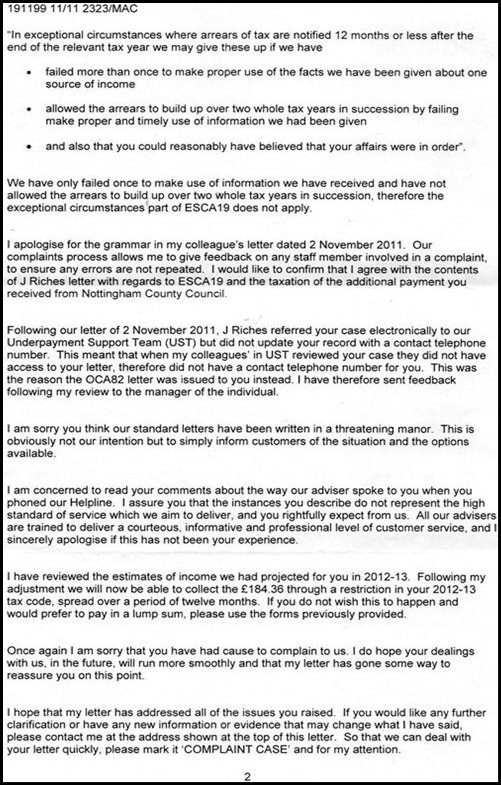

On the 21st December I received a communication ref: 191199/11/11/2323 informing me that they had received my letter of 22nd November, that they were sorry to hear about the problems I had encountered when dealing with the HMRC and went on to explain the time frame allocated to each response. In my case it would within 20 working days owing to the fact that “we are currently receiving a high level of complaints.” It was not much of a surprise to me that the department was receiving this high level of complaints but it was a great surprise for the actual admission to come in written form – again, in my opinion, an unacceptable level of unprofessionalism and although I am severely disabled and no longer able to work, I have always, throughout my own, not inconsiderable, career always benchmarked the highest level of professionalism and customer service and expect to receive the same from any professional body I need to deal with.

The following day, I received a second communication – I applaud the author in achieving her 20-day deadline in so timely a manner, which attempted to address the areas of dissatisfaction that I had highlighted :

- The author proffered another apology with reference to the problems I had encountered with my dealings with ‘us’ and would like to explain what happened in more detail.

- The author confirmed all relevant information had been received but not acted upon.

- The author states they received information from me about my ESA but that no tax had been deducted.

- ESCA19 does not apply (because they only failed once to make use of information received.)

- An apology for the grammar used in the letter dated 2nd November.

- An acknowledgement that an Assistant Officer did not update my records thus generating the ‘unable to contact you’ letter of 16th November.

- A lip-service apology with reference to finding the standard letters ‘threatening’ without acknowledging that the terminology is threatening and intimidating, the perception is that these letters are ‘informative’. (Spelling error ‘manor’ for ‘manner’).

- Concern is raised at the telephone manner of the adviser I dealt with and that this is not the usual standard.

- A review shows that payment of arrears can be made in instalments – in direct contrast to the letter dated 2nd November. It further states that if I prefer to pay the lump sum I should use the forms previously provided. (Please note the payment had already been made and encashed before this letter was written – another example of a lack of attention to detail).

- A second apology and a conciliatory paragraph to make contact again if any further clarification is required. (Appendix 6 printed double-sided showing complete letter).

Regrettably I did not think that all the points raised had been dealt with to my satisfaction and I took the opportunity of writing again to the officer dealing with my case who had intimated that to receive a quicker response the letter should be addressed to her by name. My last letter was sent 8th January and an acknowledgement dated 7th February was eventually delivered on 13th February and referred to my ‘recent letter’ stating that the turnaround was currently 25 working days and it is ‘understood that I will be disappointed.”

The letter I received was dated 13th February and was delivered to me on the 18th.

- Reference is made to the acknowledgement and turnaround period but completely ignoring the conciliatory final paragraph details given in the letter dated 22nd December.

- It was an IT error which set out that payments could not be taken as the ESA might not be a continual source.

- Confirmation that the arrears had been received but not allocated to my record (yet) and no indication as to whether or not they ever will be, which I find unsatisfactory.

- Reference is made to the HMRC error – another apology and then two interesting comments – PAYE does not relieve an individual of responsibility for their own tax affairs and the law requires that a person takes reasonable steps to ensure that their tax affairs are in order and it is their responsibility to check that their tax code is correct.

I reiterate, I have always taken steps to submit my income to HMRC to ensure I am allocated the correct tax code – I rather resent being told it is up to me to check the tax code is correct when HMRC does not explain how this can be achieved and that any problems that have arisen have been as a result of HMRC issuing an incorrect code in the first place because records have not been updated or payments not yet allocated.

- The author then goes on the offensive and insists that the letters are not written in a threatening manner but point out a customers’ obligations and consequences of ignoring them. (Appendix 7 printed double-sided showing complete letter)

At what time did I ignore HMRC? I provided a telephone number they chose not to place on record. I paid my arrears which have not been ‘recorded’ against my account. I have declared my income which has not been updated or has not been taken into account or has been ignored because it may not be a ‘continual source.’

In conclusion, HMRC are determined to pursue me for an amount that is less than £200 – they are prepared to allow hours of ‘investigation’, materials and postage to be utilised in a stubborn effort to prove that they are mightier than the individual and are unafraid of initiating bullying tactics which could easily cause enormous issues for the more vulnerable.

I would appreciate your comments at your earliest convenience and would really appreciate an end to this matter which I now feel must be concluded to lift the stain on my integrity because, regrettably the HMRC are insinuating that somehow I am in the wrong and my proof shows otherwise.

If you require copies of my letters to HMRC, I have them all stored electronically as I abhor the waste of paper and will, if required, happily send them to you via e-mail.

I thank you in advance for your time.

Yours faithfully

J A*** L*****

encl: Appendices x 7 as marked in letter.

The letter, composed on 27th February, 2012 was generated by the actions of the Complaints Officer as recounted below:

Despite the promise of a swifter response if any follow-up letter was sent, my response (as shown below) was not acknowledged until 7th February 2012 (arriving 13th February 2012). Melissa Crawford's response came on 18th February (dated 13th February) 2012. Great care was taken with this response: no spelling errors and everything under headed bullet points:

An introductory sentence pointing out that the points would be answered 'as you have raised them.'

- A sterile response as to the timeframe turnaround (it seems that the olive branch offered had been snatched back).

- Restriction in tax code - they had made the assumption that the ESA was short term and there wouldn't be enough to tax - haha! They now 'surmise' this will be longer term and therefore the IT system would no allow deductions.

-

Payment received - now allocated to 'my arrears of tax' and although banked by HMRC when las she wrote it had not yet been allocated to 'my record' - how long can it take?

- HMRC Error - as an apology had already been issued she felt that this time she should add the following admonishment "However, PAYE, does not relieve an individual of responsibility for their own tax affairs. The law requires that a person takes reasonable steps to ensure that their tax affairs are in order and it is their responsibility to check that their tax code is correct." - There, I am suitably admonished - well, silly girl should have bitten her tongue before putting that down in writing as I have now provided ample proof to the Adjudicator that I have never attempted to renege on my taxable income responsibilities and that I wouldn't know if my tax code was correct or not - that's the job of the HMRC!

- Standard letters - And here we have another admonishment this time " As stated in my previous letter our standard letters are not written in a threatening manner, they point out a customers' obligations and consequences of ignoring them." - And all the apostrophes in the right place!

- And the the final paragraph about re-assessment - a lot of gobbledegook, not they weren't going to budge, if I'm not happy I can have someone else .... blah! blah! blah! yawn!

And as I am likely to be disappointed by the outcome - they give themselves some airs and graces do they not - so now, to the Adjudicator!

Postscript update 28th February 2012

I am reminded that I also informed DWP of this underpayment on 7th December ("I have also not heard anything from DWP yet even though I have informed them of the alleged ‘underpayment’ of tax.") - as of today (28.02.2012) there has been no acknowledgement - and I should be surprised?

============================================================================================

Update 8th January 2012

I can now show you the letter that I received and will reproduce my response (without the documentation supplied as it has my bank details on!!!!) below.

I have taken my time before responding because you know how it is, you get all hot-headed and emotional and anyway, it let me relax and find a really, really stupid mistake!

So here is my response in its entirety (other than pictures of my bank statement and cheque)!

Date: 8th January 2012

Operational Manager (Customer Complaints) Pay As You Earn and Self Assessment

HM REVENUE & CUSTOMS - Complaints Service

Lynx House

1 Northern Road

Cosham

Portsmouth

PO6 3AY

For the attention of the Operational Manager (Customer Complaints) Pay As You Earn and Self Assessment

Dear Ms Crawford

[Jadwiga Anna Ludlow] [N.I. YT******A]

Your reference : 191199 11/11 2323/MAC

[Any other HMRC reference shown on the P800 – 5**/5****0

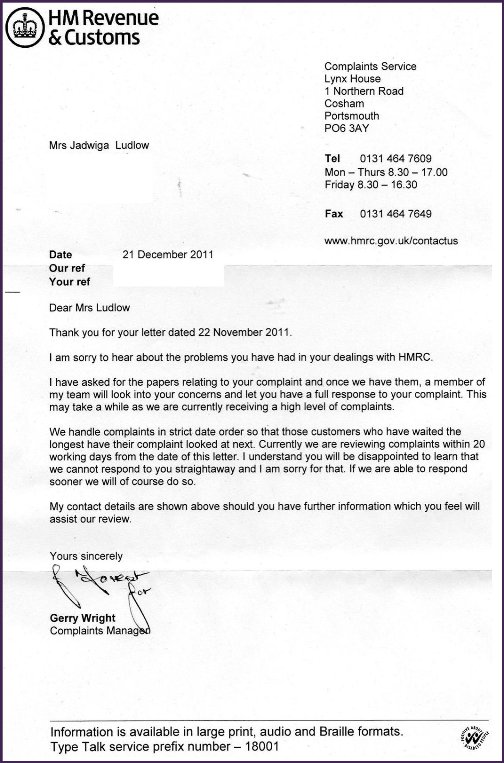

Thank you for your well structured and grammatically correct response to my correspondence dated 22nd November 2011. Thank you also for giving me the opportunity to respond to one of two of the comments/statements made in that correspondence. Most of all I thank you for your ability to recognise that my name is made up of two initials preceding my surname and that I do not necessarily use my first name on a daily basis - it is little courtesies like this that make all the difference. Regrettably the same cannot be said of your colleague, Gerry Wright who made no such effort.

To say I was astonished to receive your letter one day after that of your colleague would be an understatement, particularly as his letter stated quite clearly that “This may take a while as we are currently receiving a high level of complaints” when referring to a 20 working day turnaround for responses. I have to say that I actually find that statement indefensible and unprofessional.

What I also find untenable is that in your letter you state in paragraph 7 of page 2 the following : “I have reviewed the estimates of income we had projected for you in 2012-13. Following my adjustment we will now be able to collect the £184.36 through a restriction in your 2012-13 tax code, spread over a period of twelve months. If you do not wish this to happen and would prefer to pay in a lump sum, please use the forms previously provided.”

I would first of all bring to your attention that this option, according to more than one of your colleagues, ‘cannot be collected through your tax code’. This particular statement is made in a written communication from HM Revenue and Customs demanding payment (Ref: 507/504800/068/BIB/31B/12) dated 02.11.11. On querying this with one of your colleagues during an appalling telephone conversation, Mandy Carmichael told me that such action would ‘reduce your (meaning mine) tax code too much.’

How is it then, that you feel that a ‘restriction’ can be made in this instance. I require absolute clarification of these three statements:

1 – Why does the letter state the arrears cannot be collected through my tax code.

2 – Why does Mandy Carmichael state the reason for this is that my tax code would be reduced too much – when is a tax code reduced too much?

3 – Why do you feel you can place a restriction on my tax code which will reduce my income by £3.55 per week to retrieve my arrears.

Now then, when you have answered those queries, you may wish to consider the following:

Why would you wish to collect arrears that have already been paid?

As you will see, a cheque for the full amount was issued to HM Revenue and Customs and sent on 7th December 2011 to the address quoted in the correspondence. Although a stamped addressed envelope had been requested, it did not accompany the correspondence demanding payment of the arrears.

Cheque no. 01328 was encashed at the bank on 21st December on the very day your colleague sent his letter and a day before you composed yours. A copy of my statement, which is provided, will confirm this fact:

I now require some guarantee, in writing, that you will not attempt to defraud me out of two lots of payments.

Returning to your correspondence wherein you state that “We have only failed once to make use of information we have received ….. ESCA 19 does not apply” – I am prepared to accept that as your standards were not breached the exceptional circumstances do not apply. However, that does not excuse the incompetence of HM Revenue and Customs. In a retail world one error usually results in one of three actions : restitution, exchange and/or compensation. In the medical profession one error can mean the difference between life and death. In my former profession, one error could have resulted in my dismissal as I could well have been endangering lives by making a wrong decision. But, HM Customs and Excise apparently has no ethics and allows itself at least one error. Would that be per person per year or per transaction per person per year?

I bring to your attention an interesting fact which appeared in the Daily Telegraph as part of a general comment on the state of HM Revenue and Taxes – “Some experts claim the combined cost of tax avoidance and evasion costs Britain £125 billion a year. Which, by unhappy coincidence, is what the Government needs to borrow next year to keep the country running. ‘If we collected all the tax avoided and evaded each year, we would be one of the greatest economic superpowers on Earth’ says Tax Research UK's Richard Murphy. ‘Or if you prefer, we could pay the UK's entire educational needs for a whole year and still have £60 billion to spare.’

But, the fact that someone at HM Revenue and Customs had made only the ‘one error’ it is apparently acceptable to keep hounding me for £184.36p (in a threatening manner) and then spending many hours justifying that error. I can see that this would contribute handsomely to make a considerable dent in the £125 billion owing.

And as a final point you state “I am sorry you think our standard letters have been written in a threatening manor (your error not mine, I think you may have meant ‘manner’). This is obviously not our intention but to simply inform customers of the situation and the options available.”

Please explain to me how a letter which starts a sentence with “If you do not contact me within the next 14 days, I will recover any overdue tax from you by sending you a Self Assessment tax return or by taking legal proceedings” does not constitute a threat? Particularly as the recipient has been waiting for someone to contact her as stated in the letter dated 2nd December which also claimed the underpayment could not be collected through her code number!

The errors have all been committed by members of HM Revenue and Customs, I now have several communications written on headed paper, sent in government envelopes at the tax payers expense which provide complete proof of the blame lying squarely on the shoulders of your organisation. The conduct shown by this department and the excuses given are appalling.

I therefore ask for you to re-assess the facts in the light of your apologies and admissions and return to me the amount of £184.36p which has never knowingly been withheld from Her Majesty’s Treasury.

Once again, I await with breathless anticipation your full response to the many gaps left unanswered and of course, a complete explanation of all the continuing failures and faults which have resulted in this débâcle.

Yours faithfully

J A*** L*** (Mrs)

============================================================================================

Update - New Year's Eve

The letter (above) which states 20 working days as the benchmark, because they have so many complaints to deal with, was a complete waste of time and what is worse - money! Today - 31st December 2011 came the reply - so does that imply that they are not busy or that as usual no thought was given to the response - watch this space, I shall be posting in the New Year - all of it - including the part about how they are going to charge me for the the amount in instalments despite cashing the cheque for the full amount on Wednesday, 21st December! Howzzzzat for a Googly or should that be 'own goal?'

============================================================================================

Update on 30th December 2011

Letter from HMRC acknowledging my complaint - but I like Para 3 best of all - fancy admitting 'This may take a while as we are currently receiving a high level of complaints' - aaaaah!

Andrew says I should appreciate that they are making an effort in telling the truth, I sort of disagree, I think that admitting the volume of complaints is a defensive action and unprofessional. They should, instead, have quoted from their 'Pledge' (assuming they have one) which all government and public bodies are supposed to have in their terms and conditions ...... I'm not altogether impressed that HMRC have been awarded the 'Two Ticks Scheme' because I know quite a lot about that and should like to see their supporting documentation and proof! They are persecuting disabled people and letting the rich and carefree and healthy and criminals and artful dodgers* off scot-free! And worst of all - they probably know that the Daily Mail is on their case and that is why I have received a well-written and composed letter! Ah well, let's just see what the New Year 2012 brings - onwards and upwards!

* I think Andrew's current passion for Dickens is affecting me!

============================================================================================

Update on 22nd December 2011

Thanks to Internet Banking I have discovered that they encashed my cheque, complete with statement on the back, on Wednesday, 21st December 2011 - that didn't take them too long then eh? And still they have not acknowledged or dealt with my complaint .........

============================================================================================

Update on 20th December 2011

I found this little gem in the Daily Telegraph Magazine a couple of weeks ago :

"Some experts claim the combined cost of tax avoidance and evasion costs Britain £125 billion a year. Which, by unhappy coincidence, is what the Government needs to borrow next year to keep the country running. "If we collected all the tax avoided and evaded each year, we would be one of the greatest economic superpowers on Earth" says Tax Research UK's Richard Murphy. "Or if you prefer, we could pay the UK's entire educational needs for a whole year and still have £60 billion to spare."

So why don't they do their job properly instead of hounding me for £184.36p - that would really make a dent in the the £125 Billion owing wouldn't it?

Christmas is fast approaching and HMRC have neither responded to my complaint nor cashed the cheque I sent in on 7th December 2011.

============================================================================================

Update on 2nd December 2011

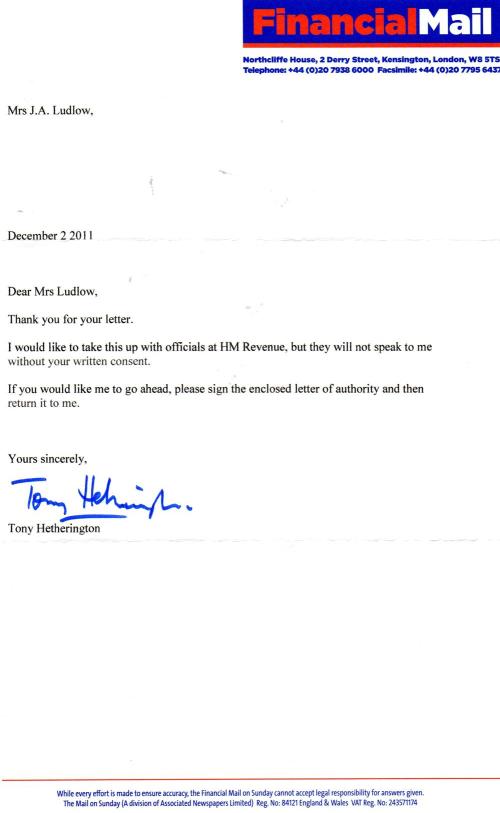

The demand for £184.36p that HM Revenue and Customs think I owe them - in the meantime - I have Tony Hetherington on my side:

Known as the Readers Champion - it is rather nice to know that he will at least be having a look into all this nonsense. My main gripe, of course is the threatening nature of the correspondence - all will be revealed as it unfolds. In the meantime, if you are still reading all this please read on for the saga so far .........

Tax Debacle Record

After everything that had happened to my sister earlier in the year – namely a tax demand approaching £3,000 and then a complete turnaround (u-turn) by HM Revenue and Customs who were then forced to reimburse* her money – I was more than astonished to find myself, the recipient for a demand of £184.36 (less a repayment for £11.04 for the tax year 2009-10) for the tax year 2010-11. (Letters purporting to have been issued on 3rd October 2011).

(*Just as a note of interest – my sister was forced to withdraw her money from her ISA account on which she subsequently lost interest and was unable to repay the amount into this account as one of the rules governing the ISA is that once removed in any particular tax year, the money cannot be returned. So not only did she go through a considerable amount of heartache, a loss of savings and interest but HM Revenue and Customs did not even offer to reimburse her for the lost interest – nice caring society we live in – dignity for the elderly eh? And I have to say that if my husband and I had not pressed the point she would not have challenged HM Revenue and Customs on this! It is precisely why I’m not going to let them get away with anything!)

To return to my own issue – up until recently, I think that most late “demands” for under £300 or £200 (not exactly sure of the amount) were to have been written off – apparently no longer and this totally inept government department is now hounding people for paltry amounts – shame they can’t catch the real villains of the piece!

So I had a look at their documentation and my documentation for the period – the P60 issued to me at the end of the tax year by my Pension Providers. The figure on my P60 and the figure on the form P800T issued by HM Revenue and Customs did not tally.

I rang my local tax office to ask if they would explain to me why I had received this tax demand and why the tally between the two sets of documentation was different. I was told to submit my P60 for scrutiny as the onus was on me to prove that an error had been made, not for anybody at HM Revenue and Customs or the DWP or my pension provider to admit errors. Very helpful (not - as the vernacular would have it). The documentation was sent off the same day as the telephone enquiry and day the demand was received – 11.10.2011 – it had taken 8 days to make its way from HM Revenue and Customs to Hucknall).

The P60 was eventually returned to me approximately a month later (letter dated 2nd November). I read it with growing astonishment as it started with ‘The underpayment of tax for 2010-11 has arose because ……’ – has arose!!!!!!! what sort of grammar is that? Was it written by some illiterate or dictated by some illiterate and then typed by another illiterate – if they want to use big words at HM Revenue and Customs then they ought to learn syntax and sentence construction and the use of tenses and participles – or is that too much to ask. Has arose – it gives me bloody nightmares! (One for Fb I think)!

As the letter also stated that “As the underpayment cannot be collected though your code number we will contact you with regards payment of the outstanding tax of £184.36.” It does not state why underpayment cannot be collected through my code number.

So having received said letter I decided that I didn’t wish for any further stress so filed it and awaited the momentous day when ‘they’ would contact me with their instructions.

Update 21st November 2011 relative to above:

Yesterday (21st November 2011) I received a really nasty communication stating they had been unable to contact me as they do not hold a phone number on record for me. They referred to the letter I had sent on 10th October (posted on 11th) – I’ve just had a look at that letter and plain as day – it not only has my full address on it, but also my telephone number and an e-mail address.

The following is what happened yesterday when I rang HM Revenue and Customs (at this stage not having my paperwork to hand I had not realised that I have PROOF that my telephone number is on the letter dated 10th).

I spoke to a person called Yasser – eventually it transpired that this man is but a call-taker – the telephone number at the top of the letter form ref: HMRC 05-11 OCA82 which it is written on only provides the bog-standard (expensive 0845 prefix) helpline number – so by the time you’ve made your selections, listened to some totally inappropriate metallic sounds purporting to be music and heard the same message about an adviser being with you shortly, you’ve paid for 20 minutes of the same old crap you’ve heard before! First of all Yasser had to ask me routine ‘security’ questions – my full name, my full address, my NI number, my telephone number and my DOB – having got through that he then asked me how much I owed? I told him to get his finger out and look it up on the computer screen he had in front of him as I had no access to my own paperwork, computer at that particular time. So he noted the amount and then said quite blatantly that the UST team had tried and failed to contact me. I asked him when the UST team had attempted to contact me and what the acronym stood for, I also added that I did not appreciate being sent letters of this bullying kind implying a threat of taking legal proceedings when no viable attempt at contact had been made! He admitted that the organisation was very large and he did not know what the acronym of UST stood for – he asked me to wait and either asked a colleague or looked it up on the inter/intranet because he came back, quite triumphantly after another wasted three minutes to declare it stood for ‘Underpayment Specialist Team’ (oh lord, do they even know the definition of ‘specialist?)** He finally confessed that he could not do anything about this or anything else I had discussed but he would send an e-mail to the UST Team and then wanted me to choose a time for when it would be most convenient for me to talk to the UST. I decided the best thing would be between 2-5pm on any particular day as I rarely go out these days.

As one of the things Yasser had said was that it took a few days before the UST made contact, I was not expecting them to ring back today, 22nd November 2011 at just before midday. But you know, you get a 6th sense about these things – these dummies think they can catch you unprepared …. too bad, I had already put aside, today to get this lot sorted out – so not only am I near my computer and by extension my ‘photocopier’ which is my printer but also all the correspondence and paperwork I need to make copies of for the Daily Mail, the DWP and the HM Revenue and Customs complaints department!

So in fact when the phone rang, I rather expected that it was somebody from the UST – and it was! – Mandy Carmichael had drawn the short straw in having to deal with me personally and not taking into account that she was not dealing with someone with less than half a brain cell. I challenged the fact that she rang me outside of the hours given and she immediately gave me the option of phoning later but (I didn’t tell her this) having got her on the line, she was not going to get away that easily – ha! ha!

She rang as asked for me by title and name – Mrs Ludlow (luckily not attempting to mispronounce Jadwiga – these people just don’t get it do they? Their political correctness has forbidden the use of ‘Christian Name’ for fear of offending non-Christians and insist on ‘First name’ which is fine and dandy but I don’t use my first name – I am known by my second name of ‘Anna’ – my sister is know by her second name – in forms these things are now called initials – well – I think, if people are going to be politically correct, they should find out how a person wishes to be addressed – by a title, their first name or a Christian name of their preference or a name of their preference – ye gods they don’t know anything!) So I asked who she was and she told me she was from HM Revenue and Customs – so I told her that I wanted her name and that I wanted some answers. She gave me her name but refused to go further until I had answered the ‘security’ questions – hadn’t she rung me? Full name, full address, DOB – did I know my NI number? Now would she answer my questions?

- When writing a letter of the nature and tone of the OCA82 referring to a specific letter, would they have that letter in front of them (by the way they claim the letter was dated 12th October not 10th – I’m guessing whoever looked at it typed the ‘date received’ rather than the ‘date written’). She said she could not say for definite, but maybe not necessarily so. I informed her that I had a copy of the letter and that it categorically stated my name, address, e-mail address and telephone number. She backtracked – she stated that my record had obviously not been updated which is why when the UST tried to contact me they could not find a telephone number – ok – whose fault is that then – did I or did I not provide my telephone number? Yes I did so the statement in the letter is a lie! She wasn’t too happy about that being pointed out to her and she ‘couldn’t comment on the actions of any of her other team colleagues.’ I don’t get it – if a call operator can pick up on a message that says the UST tried to contact me – how come Mandy can’t comment on her colleagues – the silly thing is that I’m guessing the letter (like at the my GPs these days) has been scanned in because she referred to it and saw that the telephone number was there – coincidentally the same one she was talking to me on now.

Extraordinarily she then asked me if I was willing to make the payment or was I going to make another appeal – however, she did not tell me how I could appeal and then asked me if I was still going to make a complaint, I told her I was – so she said she would not be going any further with this.

I told her she’d better not try that as I still had questions and that I intended to pay the full amount – the whole paltry £184.36 by cheque in one go (what I didn’t tell her was that I intend to fill the back up with comments of protest) despite the fact that there were millions out there that have not been paid as a result of fraud and they are chasing me – a severely disabled woman for that amount! More to the point a disabled woman that had always paid her income tax in all the years she was able to work! I also asked her why one of the letters claimed that ‘the underpayment cannot be collected through your tax code’ – the answer ‘it would reduce your tax code too much – currently at 390L’ – that didn’t tell me too much either – how can a tax code be reduced too much? How is it different to have to pay by DD – what planet are they on???????

I then asked her why she kept referring to ‘underestimating’ the amount of ESA when every time there was a change I reported it to HM Revenue and Customs - whose fault is that then?

I told her that she was to send me the paperwork for a full repayment which apparently is a form OCA54 letter which confirms our conversation today and informs me of the correct way of completing a cheque or other method of payment for the full amount and who to send it to. Although I had to prompt, I was told a pre-paid envelope would be provided.

I advised her that I would proceed with my complaint but thanked her for ringing me so swiftly and would make a particular mention of that.

I also told her I wasn’t going to let this go away because there are people out there who have a frailer mentality and who may well suffer horribly as a result of these abominations that they call correspondence.

So now that this out of my system, let Battle Commence – oh hey I wish I still smoked this would be a great fag break!

Postscript update 28th November 2011 relative to above:

PostScript – 28.11.2011 – Well the OCA54 letter arrived – it’s another appallingly worded form letter – I love this sentence which starts off the letter “Thank you for contacting us about the PAYE you of £184.36.” Talk about wanting your pound of flesh, I can’t believe they still want to retrieve this considering the millions that must be out there that have defrauded HM Revenue and Customs thanks to their own incompetence. There was also a yellow post it attached (scanned) requesting that an s.a.e. be enclosed ‘if possible’ – well it wasn’t so they can now wait for my response! The cheque will be written out for the correct amount and the entire reverse will be subjected to my thoughts – or as much as I shall be able to fit in the space! Lessons in courtesy and common sense would not come amiss to these people – where do they find them?

Also as at today’s date (28.11.2011) there has been no response to my complaint or the fact that I have informed the DWP of the Tax Demand and nothing from the Financial Mail – but in all honesty they don’t claim to respond, they may or may not use my story but hopefully it helps to wind up the HMRC crew and expose their continuing incompetence and illiteracy. ;-)

** as a noun : a person who concentrates primarily on a particular subject or activity; a person highly skilled in a specific and restricted field:

- as an adjective : possessing or involving detailed knowledge or study of a restricted topic:

- attributable (which is probably they way they would like to see themselves : concentrating on a restricted field , market, or area of activity:

all from the Oxford On-Line dictionary and the example they give for attributable is : a specialist electrical shop – I rather like that!

Update 5th December 2011 relative to above:

On 5th December I was pleasantly surprised to received a letter from Tony Hetherington of the Financial Mail who has agreed to take up my complaint. I have had to sign an authority for him to go ahead as HRMC will not release anything without written consent – I wonder which security questions they will pose to him? Anyway, today, 6th December I have decided to sort out the administrative parts of this mess to get things moving.

I have signed the authority and together with a covering letter this will be returned to Mr. Hetherington tomorrow at the latest.

I have now also issued a cheque no: 1328 to HM Revenue and Customs quoting my NI number as part of the reference. On the rear of the cheque I have made the following observation : “This cheque for “owed” tax has been written out under the strongest protest. HMRC have bullied me into this payment by sending communications threatening to take me to court to claim back the “underpayment” created by their well-publicised incompetence, These bullying tactics have been employed against the vulnerable in our society including myself, a severely mobility impaired woman who has paid tax all her life! Shame on you all! Shame! Shame!” (I couldn’t fit any more in – wish I had had room to put ‘fictitious’ before “underpayment” but I didn’t so it will have to suffice on this web-site ;-)

This will also be sent tomorrow (7th) so that theoretically they should both arrive at the same time and then be available for further investigation.

I have also not heard anything from DWP yet even though I have informed them of the alleged ‘underpayment’ of tax.

Page updated : 11th November 2016